|

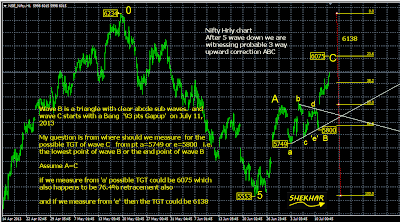

| NIFTY WEEKLY CHART |

|

| Nifty Spot Weekly Chart |

This is another chart Nifty Spot which shows a better rounded formation (because of sudden plunge) and handle also seems to have been done. One can have his own independent views. As a trader we know when to and how to enter a trade.

Here is a small write up from Investopedia on C&H pattern.

This is a bullish continuation pattern where the upward trend has paused, and traded down, but will continue in an upward direction upon the completion of the pattern. This pattern can range from several months to a year, but its general form remains the same. The construct of the cup itself is also important: it should be a nicely rounded formation, similar to a semi-circle. The reason is that a cup-and-handle pattern is a signal of consolidation within a trend.

Keep an Eye !

SHEKHAR